There’s no limit on how much money you can give or receive as a gift! If you gift over the value of the gifting free areas we’ll do both of these:

There is no gift tax in australia (how your children may be affected is dealt with below), but if you’re receiving the age pension or any other social security benefit from centrelink, there are limits to the value of gifts that you can give. This annual gifting can be done each year without affecting the taxpayer’s lifetime gift and estate tax exemption.

TaxFree Gifts What Is It And How Much Can You Give? Crixeo, For gifts of money, you can claim a deduction where the amount of the gift is $2 or more. If the total of gifts made in a financial year is more than $10,000, the excess will be assessed as a deprived asset.

Gift Tax Limit 2025 How Much Can You Give TaxFree? Kiplinger, However, if you are receiving the age pension or other benefits from the government, there is a limit to the amount you can gift your children. Can a family member’s gift be taken away if they go bankrupt?

What Is The Gift Tax And How Much Can You Gift TaxFree? YouTube, You are responsible for making multiple gifts totalling $17,000 to people of your choice without paying the gift tax. You can also claim a deduction for:

Tax Brackets 2025/24 Australia Sula, You can choose to give away any amount and as many gifts as you like. A donation to an approved organisation of shares listed on an approved stock exchange valued at $5,000 or less;

How Much Can I Give Away Without Incurring Gift Tax Issues? Peach, Will i have to pay taxes on a gift given to a family member in australia? For gifts of money, you can claim a deduction where the amount of the gift is $2 or more.

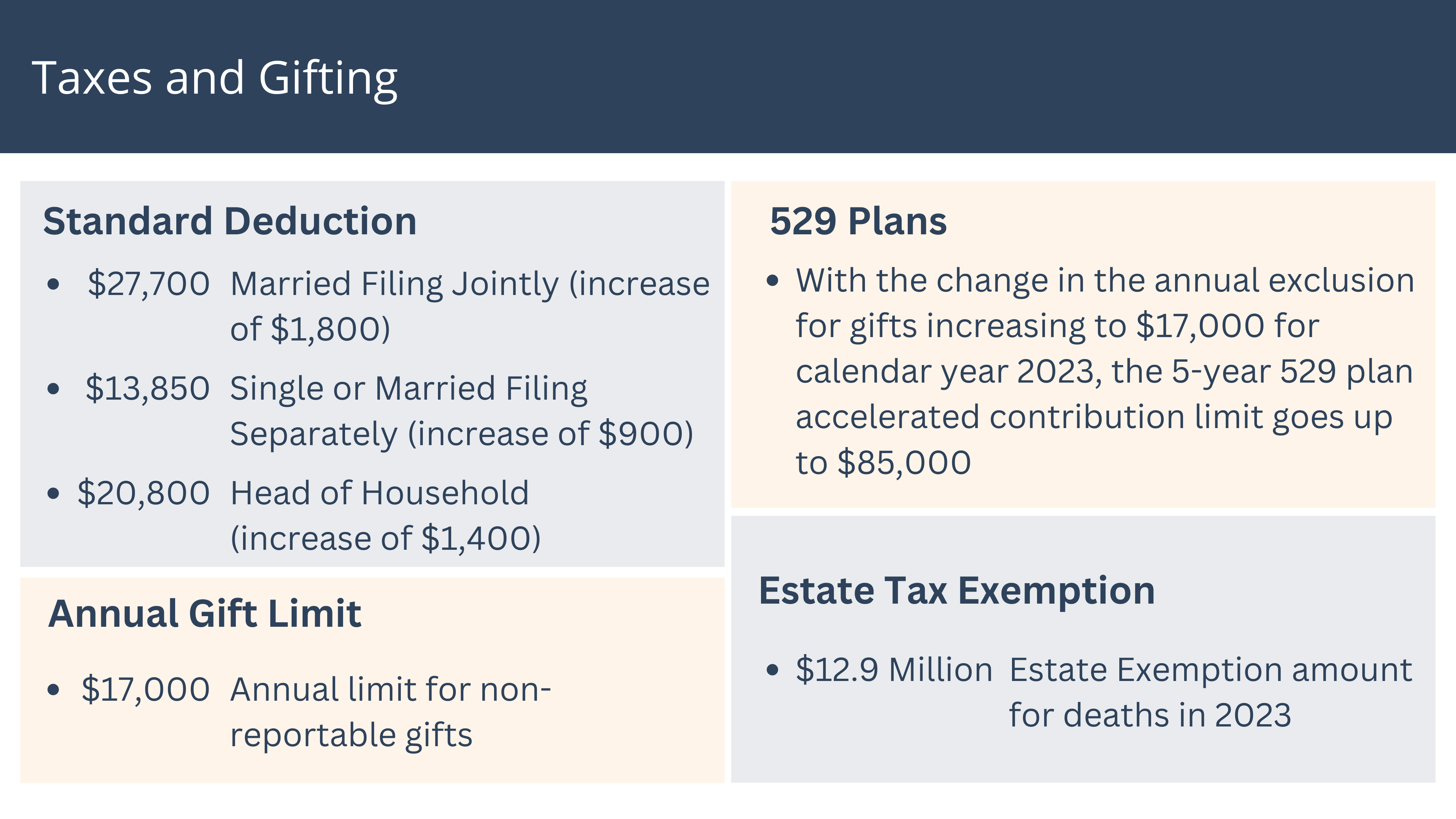

What is the annual gift tax exclusion for 2025? Leia aqui How much can, The cap is $17,000 per recipient for an annual gift in the 2025 tax year. However, if you are receiving the age pension or other benefits from the government, there is a limit to the amount you can gift your children.

Gift Tax Explained What It Is and How Much You Can Gift TaxFree, Can a family member’s gift be taken away if they go bankrupt? You can choose to give away any amount and as many gifts as you like.

:max_bytes(150000):strip_icc()/money-for-you-172411636-fbc9ab4f707a49c08e17bc07f45f3f1d.jpg)

How Much Can You Gift TaxFree? A Clear Guide to Gift Tax Allowances, Can a family member’s gift be taken away if they go bankrupt? For more information about what a gift is and examples of gifts, see tr 2005/13 income tax:

Gift Tax Explained What It Is and How Much You Can Gift TaxFree, Gifting free areas $10,000 in one financial year. The $10,000 a year, $30,000 over five years, which you refer to, are the maximum amounts a person can give away without affecting their pension.

Can I Save on Taxes by Gifting? YouTube, This means a married couple could gift up to $36,000 in cash or assets to each child without any direct tax ramifications. For example, if you were to invest a tax cut of $1,179 per year, assuming a 10.9% return (the average nasdaq 100 annual return for the last 20 years) that could go up to as much as $74,832.

If the total value of your gifts is more than the value of the gifting free area, your payment may be affected.